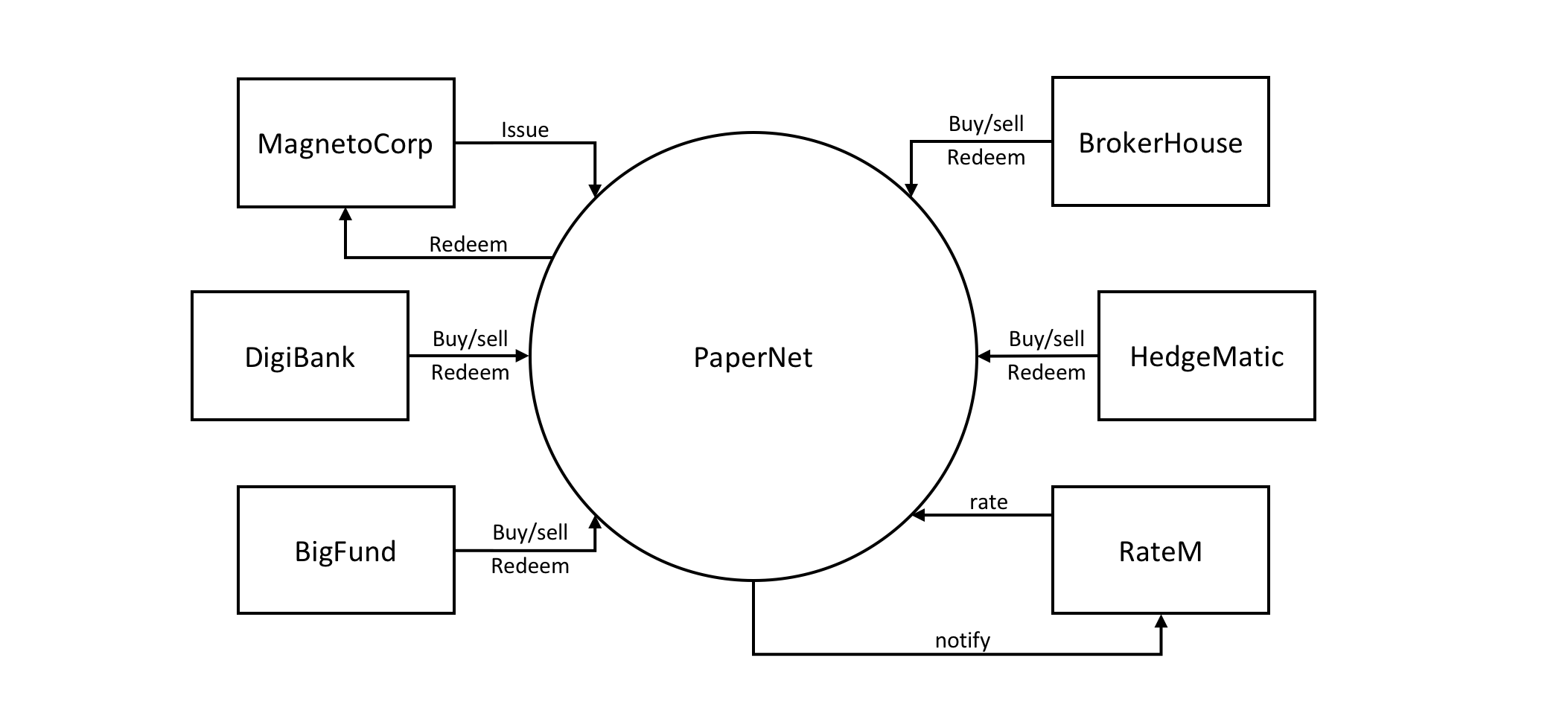

github.com/kaituanwang/hyperledger@v2.0.1+incompatible/docs/source/developapps/scenario.md (about) 1 # The scenario 2 3 **Audience**: Architects, Application and smart contract developers, Business 4 professionals 5 6 In this topic, we're going to describe a business scenario involving six 7 organizations who use PaperNet, a commercial paper network built on Hyperledger 8 Fabric, to issue, buy and redeem commercial paper. We're going to use the 9 scenario to outline requirements for the development of commercial paper 10 applications and smart contracts used by the participant organizations. 11 12 ## PaperNet network 13 14 PaperNet is a commercial paper network that allows suitably authorized 15 participants to issue, trade, redeem and rate commercial paper. 16 17  18 19 *The PaperNet commercial paper network. Six organizations currently use PaperNet 20 network to issue, buy, sell, redeem and rate commercial paper. MagentoCorp 21 issues and redeems commercial paper. DigiBank, BigFund, BrokerHouse and 22 HedgeMatic all trade commercial paper with each other. RateM provides various 23 measures of risk for commercial paper.* 24 25 Let's see how MagnetoCorp uses PaperNet and commercial paper to help its 26 business. 27 28 ## Introducing the actors 29 30 MagnetoCorp is a well-respected company that makes self-driving electric 31 vehicles. In early April 2020, MagnetoCorp won a large order to manufacture 32 10,000 Model D cars for Daintree, a new entrant in the personal transport 33 market. Although the order represents a significant win for MagnetoCorp, 34 Daintree will not have to pay for the vehicles until they start to be delivered 35 on November 1, six months after the deal was formally agreed between MagnetoCorp 36 and Daintree. 37 38 To manufacture the vehicles, MagnetoCorp will need to hire 1000 workers for at 39 least 6 months. This puts a short term strain on its finances -- it will require 40 an extra 5M USD each month to pay these new employees. **Commercial paper** is 41 designed to help MagnetoCorp overcome its short term financing needs -- to meet 42 payroll every month based on the expectation that it will be cash rich when 43 Daintree starts to pay for its new Model D cars. 44 45 At the end of May, MagnetoCorp needs 5M USD to meet payroll for the extra 46 workers it hired on May 1. To do this, it issues a commercial paper with a face 47 value of 5M USD with a maturity date 6 months in the future -- when it expects 48 to see cash flow from Daintree. DigiBank thinks that MagnetoCorp is 49 creditworthy, and therefore doesn't require much of a premium above the central 50 bank base rate of 2%, which would value 4.95M USD today at 5M USD in 6 months 51 time. It therefore purchases the MagnetoCorp 6 month commercial paper for 4.94M 52 USD -- a slight discount compared to the 4.95M USD it is worth. DigiBank fully 53 expects that it will be able to redeem 5M USD from MagnetoCorp in 6 months time, 54 making it a profit of 10K USD for bearing the increased risk associated with 55 this commercial paper. This extra 10K means it receives a 2.4% return on 56 investment -- significantly better than the risk free return of 2%. 57 58 At the end of June, when MagnetoCorp issues a new commercial paper for 5M USD to 59 meet June's payroll, it is purchased by BigFund for 4.94M USD. That's because 60 the commercial conditions are roughly the same in June as they are in May, 61 resulting in BigFund valuing MagnetoCorp commercial paper at the same price that 62 DigiBank did in May. 63 64 Each subsequent month, MagnetoCorp can issue new commercial paper to meet its 65 payroll obligations, and these may be purchased by DigiBank, or any other 66 participant in the PaperNet commercial paper network -- BigFund, HedgeMatic or 67 BrokerHouse. These organizations may pay more or less for the commercial paper 68 depending on two factors -- the central bank base rate, and the risk associated 69 with MagnetoCorp. This latter figure depends on a variety of factors such as the 70 production of Model D cars, and the creditworthiness of MagnetoCorp as assessed 71 by RateM, a ratings agency. 72 73 The organizations in PaperNet have different roles, MagnetoCorp issues paper, 74 DigiBank, BigFund, HedgeMatic and BrokerHouse trade paper and RateM rates paper. 75 Organizations of the same role, such as DigiBank, Bigfund, HedgeMatic and 76 BrokerHouse are competitors. Organizations of different roles are not 77 necessarily competitors, yet might still have opposing business interest, for 78 example MagentoCorp will desire a high rating for its papers to sell them at 79 a high price, while DigiBank would benefit from a low rating, such that it can 80 buy them at a low price. As can be seen, even a seemingly simple network such 81 as PaperNet can have complex trust relationships. A blockchain can help 82 establish trust among organizations that are competitors or have opposing 83 business interests that might lead to disputes. Fabric in particular has the 84 means to capture even fine-grained trust relationships. 85 86 Let's pause the MagnetoCorp story for a moment, and develop the client 87 applications and smart contracts that PaperNet uses to issue, buy, sell and 88 redeem commercial paper as well as capture the trust relationships between 89 the organizations. We'll come back to the role of the rating agency, 90 RateM, a little later. 91 92 <!--- Licensed under Creative Commons Attribution 4.0 International License 93 https://creativecommons.org/licenses/by/4.0/ -->